WASHINGTON — President Biden signed an executive order on Wednesday that will direct the federal government to come up with a plan to regulate cryptocurrencies, recognizing their popularity and potential to destabilize traditional money and markets.

The order, under development for months, will coordinate efforts among financial regulators to better understand the risks and opportunities presented by digital assets, particularly in the areas of consumer protection, national security and illicit finance.

The move, according to a fact sheet on the order released by the Biden administration, is a response to the “explosive growth” in digital assets, the growing number of countries exploring central bank digital currencies and a desire to maintain American technological leadership. It directs financial regulators to continue with work that began in earnest last year, including studying and reporting on the creation of a digital dollar.

The eventual results could help shape the contours of a rapidly innovating industry that has swiftly moved into the mainstream, but that critics say enables illicit activity and creates outsize financial risks, both for consumers and the economy.

“The rise in digital assets creates an opportunity to reinforce American leadership in the global financial system and at the technological frontier, but also has substantial implications for consumer protection, financial stability, national security and climate risk,” the White House said in a statement.

The order lays out a national policy for digital assets across six areas: consumer and investor protection; financial stability; illicit finance; U.S. leadership in the global financial system and economic competitiveness; financial inclusion; and responsible innovation.

Experts on cryptocurrencies have long called for the government to streamline what had been a scattershot approach.

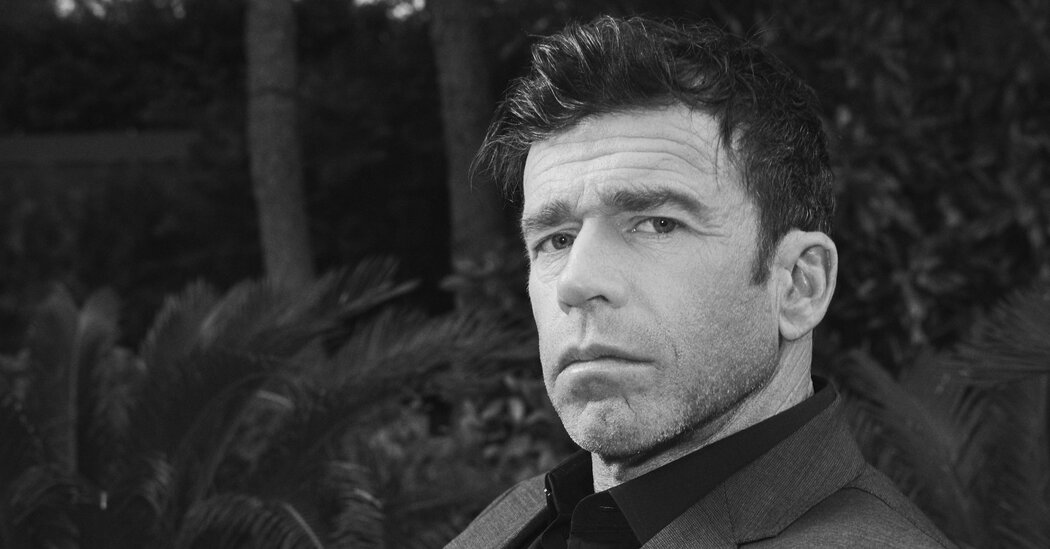

“We need clear answers on how to do things,” Louis Lehot, a cryptocurrency expert at the law firm Foley & Lardner, said in an interview. “We’re operating in a gray zone and in a sandbox. And time and again, someone comes into the sandbox and arrests somebody, and that’s not the best way to grow an important part of the economy.”

He added: “We’ve seen a complete lack of any strategic direction or thought from the federal government for years. The industry still doesn’t know what’s a security, for example, and what’s a utility token that is exempt from regulation. Those are things that would help us.”

The order comes amid concerns that Moscow will use cryptocurrency to evade punishing sanctions issued by the United States government over Russia’s invasion of Ukraine. A senior administration official who detailed the contents of the order but was not authorized to speak about it publicly told reporters on Tuesday evening that work on it predated the Ukraine war. Cryptocurrency would not be a viable way for Russia to circumvent sanctions, the official said.

A Guide to Cryptocurrency

A glossary. Cryptocurrencies have gone from a curiosity to a viable investment, making them almost impossible to ignore. If you are struggling with the terminology, let us help:

But the geopolitical situation exacerbates longstanding concerns about the role of anonymity in cryptocurrency and the risk of illicit activity that results. The blockchain technology underlying cryptocurrencies gives anyone who can read computer code the ability to track transactions, ostensibly eliminating the need for trust between transacting parties and allowing for anonymity.

Names and personal identifying information are not always required to participate in the crypto economy — on many decentralized platforms, programs and apps, code runs the show. But as the crypto industry and its offerings balloon, attracting ever more money to projects that defy traditional business definitions, increasingly vast amounts of digital assets are being managed by major players — including venture capitalists and developers — who operate without sharing their names.

To what extent regulators will attempt to change this will become more apparent after they conduct the studies and write the reports that will be directed by the order.

David Yaffe-Bellany contributed reporting.