This additionally comes amid rising predictions that BTC may surge to $100,000 by the tip of the yr. What’s actually taking place proper now?

Bitcoin’s Spectacular Efficiency Results in Greed

During the last seven days, Bitcoin’s value has elevated by practically 20%. This value improve was because of Donald Trump’s sweeping victory within the US elections on November 5. The numerous rise in institutional urge for food for BTC may be linked to the cryptocurrency’s leap to a brand new all-time excessive.

To find out whether or not Bitcoin may climb larger or if we’ve hit a neighborhood high, it’s essential to identify whether or not the market is extraordinarily grasping or in worry. In response to Glassnode, the Bitcoin worry and greed index has hit the intense greed degree. Created by Different.me, this metric measures investor sentiment in a single quantity by aggregating knowledge from a number of sources.

Starting from 0 to 100, values near 0 signify “extreme fear,” reflecting heightened detrimental sentiment. Most often, this area signifies an nearly excellent accumulation level. However, a rating of 100 or near it represents “extreme greed,” indicating most Concern of Lacking Out (FOMO). If sustained, this place, as seen above, could lead on Bitcoin’s value to a correction part.

Bitcoin Concern and Greed Index. Supply: Glassnode

12 months-to-date, the final time the index hit such a degree, BTC’s value collapsed weeks later and went on a protracted correction and consolidation part. Due to this fact, if previous efficiency influences latest occasions, BTC could possibly be near retracement.

Apparently, this improvement coincides with a warning by CryptoQuant CEO Ki Younger Ju. On Sunday, November 10, Younger Ju posted that the BTC value prediction on the finish of the yr could possibly be a lot decrease, at $58,974. He additionally talked about that the seemingly overheated market may result in a Bitcoin value correction in 2025.

“I expected corrections as BTC futures market indicators overheated, but we’re entering price discovery, and the market is heating up even more. If correction and consolidation occur, the bull run may extend; however, a strong year-end rally could set up 2025 for a bear market,” Ki Younger Ju emphasised on X.

Buyers Proceed to Purchase, however Analyst Advises Warning

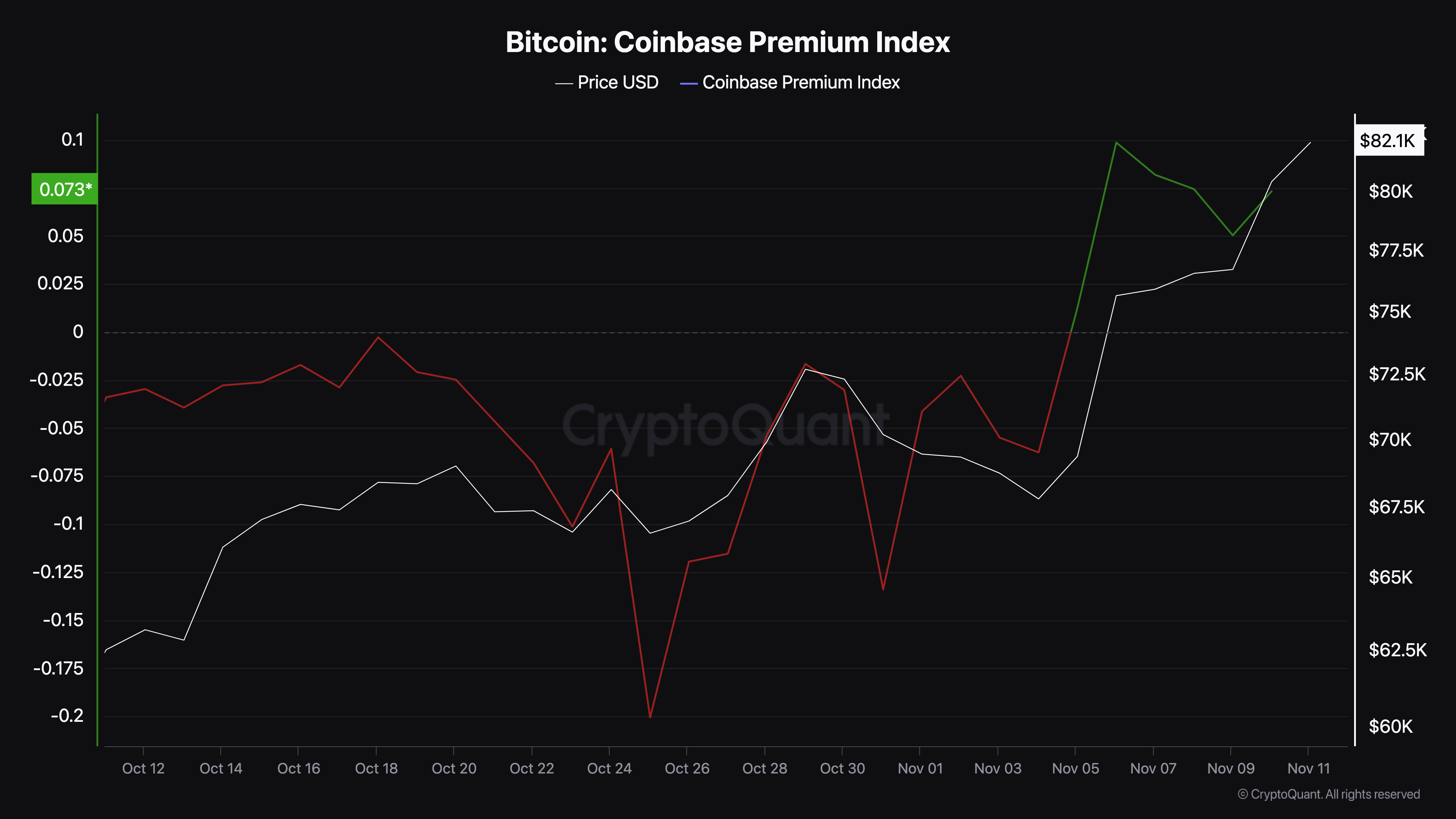

Regardless of CryptoQuant CEO’s opinion, the Coinbase Premium Index has proven a notable improve. This index measures the exercise of US traders. Excessive premium values may point out sturdy shopping for strain from US traders on Coinbase.

Conversely, a low worth may recommend excessive promoting strain. Due to this fact, because the present studying suggests in any other case, Bitcoin’s value may proceed to climb.

Bitcoin Coinbase Premium Index. Supply: CryptoQuant

Bitcoin Coinbase Premium Index. Supply: CryptoQuant

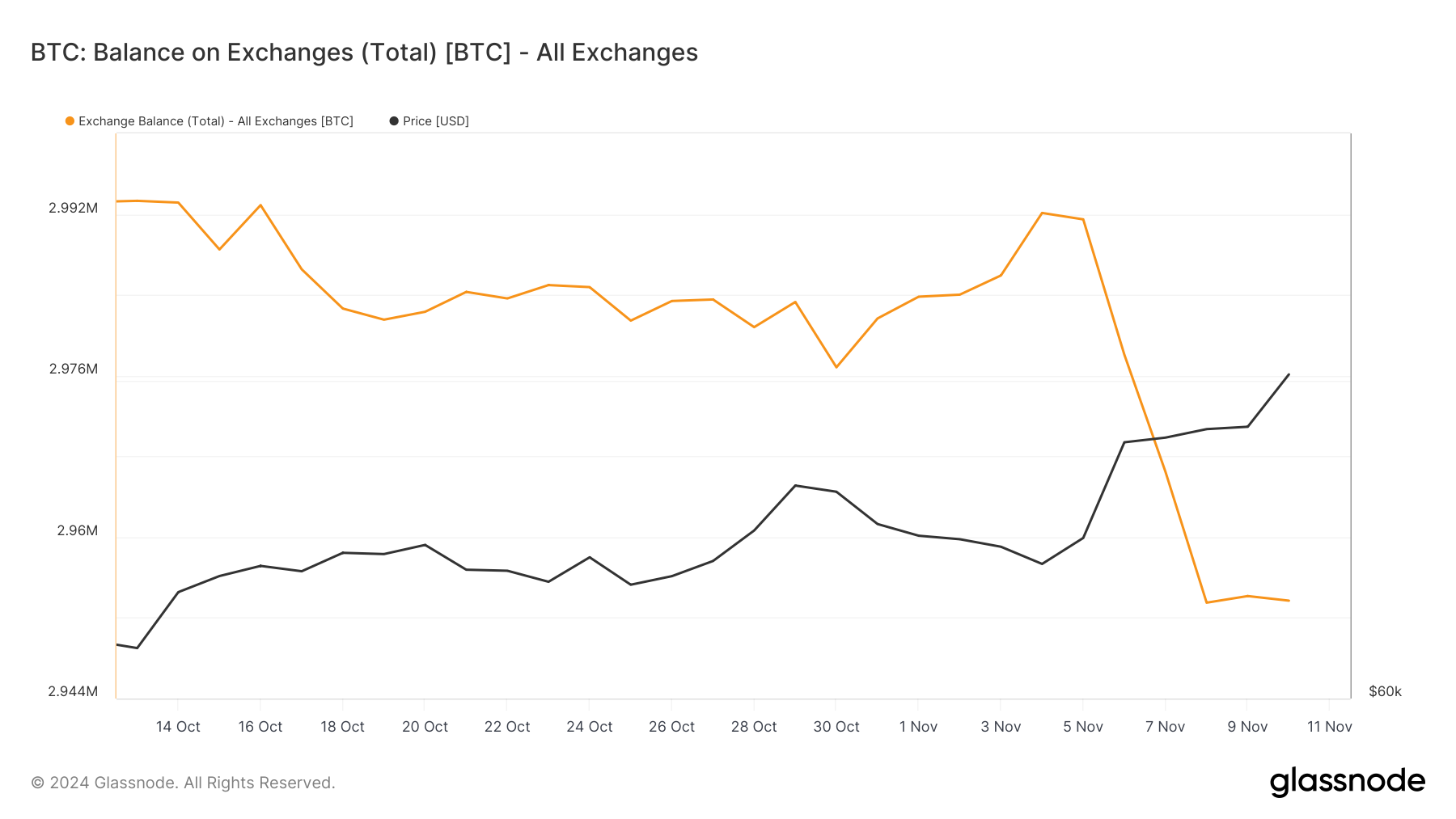

Moreover, Glassnode knowledge reveals that the BTC stability on exchanges has considerably decreased. The stability on exchanges is the entire variety of cash held in alternate addresses.

When it will increase, it implies that many holders are ready to promote, which may result in a drawdown. Primarily based on the information above, Bitcoin holders have withdrawn practically 40,000 BTC from exchanges since November 5.

On the present value, that is price over $3 billion. If sustained, then a Bitcoin value correction may not occur within the brief time period. As an alternative, the cryptocurrency’s value may proceed to rise.

Bitcoin Steadiness on Exchanges. Supply: Glassnode

Bitcoin Steadiness on Exchanges. Supply: Glassnode

Crypto analyst Michaël van de Poppe, like Younger Ju, additionally identified that the numerous improve in futures positions may push Bitcoin’s value down initially earlier than the uptrend resumes.

“Massive futures positions are open and I think we’ll see a flush happening in the coming week before we continue the upward trend.These flushes are tremendous opportunities,” van de Poppe stated.

BTC Value Prediction: RSI Steps Into Overbought Zone

Bitcoin is at present priced at $84,760, and the day by day chart reveals the cryptocurrency buying and selling above each the 20-day and 50-day Exponential Shifting Averages (EMAs). Being above these ranges means that Bitcoin’s pattern is bullish.

Nevertheless, the Relative Energy Index (RSI), which measures momentum, has seen its studying rise above 70.00. Usually, when the RSI is beneath 30.00, it’s oversold. However since it’s above 70.00, it means BTC is overbought.

Bitcoin Day by day Evaluation. Supply: TradingView

Bitcoin Day by day Evaluation. Supply: TradingView

Therefore, there’s a likelihood that Bitcoin’s value may bear a fast correction. If that occurs, then the cryptocurrency may drop to $76,571. However, if bulls don’t give bears any respiratory area as issues stand, this may not occur. As an alternative, BTC may rally above $86,000 and get nearer to $100,000.