CEOs are utilizing the market growth to quietly money in their very own chips.

Insiders at US corporations have dumped $5.7 billion of inventory this month, the very best in any September over the previous decade, in response to an evaluation of regulatory filings by TrimTabs Funding Analysis.

It isn’t a brand new development. Insiders, which embrace company officers and administrators, offered shares in August on the quickest tempo in 10 years as effectively, TrimTabs mentioned.

The promoting is noteworthy as a result of it occurred because the market rebounded sharply from an early 2018 tumble. Fueled by tax cuts and a robust economic system, the Dow not too long ago notched its first report excessive since January.

Some company insiders have a lot of their internet price tied up in inventory, so it may very well be that they’re merely exercising warning. The bull market, already the longest historical past, cannot final ceaselessly.

“It’s a very prudent thing for them to unload some shares — no matter how much they like the stock,” mentioned Joe Saluzzi, co-partner at brokerage agency Themis Buying and selling. “It doesn’t necessarily mean they see something wrong.”

TrimTabs doesn’t break down how lots of the insider gross sales had been pre-planned. The SEC permits executives to schedule inventory gross sales forward of time to keep away from the looks of insider buying and selling.

Whereas the captains of Company America are cashing out, they’re doing the precise reverse with shareholder cash.

US public corporations have licensed a shocking $827.4 billion of inventory buybacks in 2018 — already a report for any 12 months, in response to TrimTabs. Apple (AAPL) alone introduced plans final quarter for $100 billion of buybacks.

The flurry of buybacks has been seen by traders as an indication of confidence amongst CEOs.

“Insiders aren’t announcing buybacks because they think stocks are cheap,” mentioned David Santschi, director of liquidity analysis at TrimTabs. “What they’re doing with shareholders’ money and their own is quite different.”

Firms use buybacks as a strategy to return extra money to shareholders. Share repurchases profit traders — and executives which are paid principally in inventory — by offering persistent demand that tends to spice up costs. Buybacks additionally artificially inflate earnings per share by eliminating the variety of shares excellent.

Company America is having fun with report profitability because of the robust economic system and an enormous discount in what they owe Uncle Sam. The Republican tax legislation diminished the company tax price to 21% from 35% and likewise gave corporations a break on international earnings which are returned to the US.

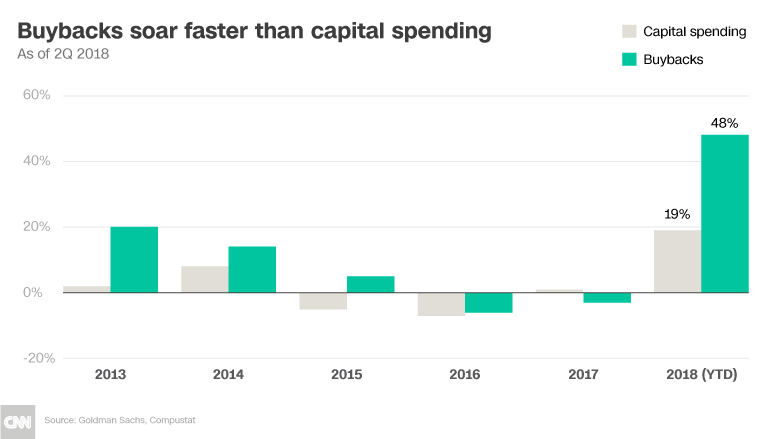

The tax windfall has additionally enabled corporations to spend extra on job-creating investments like new gear and analysis initiatives. However buybacks are rising even quicker. In actual fact, Goldman Sachs discovered that buybacks are garnering the biggest share of money spending by S&P 500 corporations for the primary time in a decade.

Given the spike in buybacks, Saluzzi mentioned it might be odd if insiders are quickly dumping shares outdoors of preplanned transactions.

“You’ve got to raise your eyebrows and look at what’s going on here,” Saluzzi mentioned.

CNNMoney (New York) First printed September 26, 2018: 12:42 PM ET