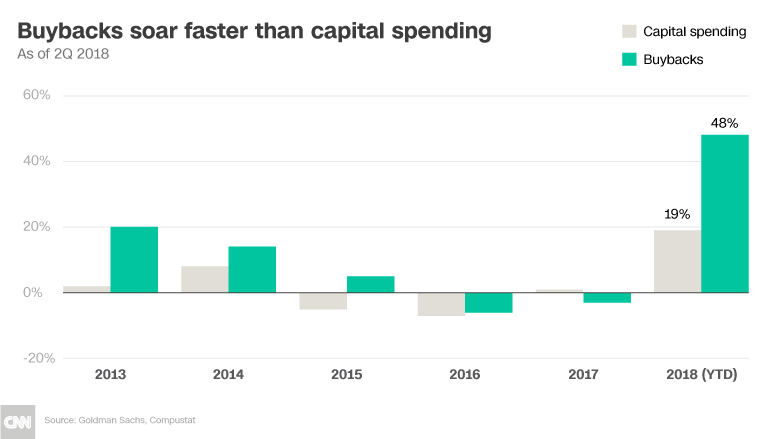

For the primary time in a decade, Company America is steering extra money into inventory buybacks than investing sooner or later.

S&P 500 firms rewarded shareholders with $384 billion value of buybacks through the first half of 2018, based on a Goldman Sachs report printed Friday. That massive bonanza for Wall Avenue is up 48% from final yr and displays spiking profitability due to company tax cuts and the sturdy US economic system.

However that does not imply firms aren’t spending on job-creating investments, like new tools, analysis initiatives and factories. Enterprise spending is up 19% — it is simply that buybacks are rising a lot quicker.

In actual fact, Goldman Sachs mentioned that buybacks are garnering the most important share of money spending by S&P 500 companies. It is a milestone as a result of capital spending had represented the one largest use of money by companies in 19 of the previous 20 years.

And the development is probably not finished but. Goldman Sachs predicted that share buyback authorizations amongst all US firms in all of 2018 will surpass $1 trillion for the primary time ever.

Apple (AAPL) alone spent a whopping $45 billion on buybacks through the first half of 2018, triple what it did throughout the identical time interval final yr, the agency mentioned. That included a record-shattering sum through the first quarter.

Amgen (AMGN), Cisco (CSCO), AbbVie (ABBV) and Oracle (ORCL) have additionally showered buyers with massive boosts to their buyback packages.

‘Blackout’ poses threat

Buybacks are sometimes cheered by shareholders, at the least within the quick time period. One motive is that buybacks artificially inflate earnings per share by eliminating the variety of shares excellent.

Furthermore, firms getting into the market with big buy orders present persistent demand, lifting share costs.

The influence of buybacks is so profound that some fear about how shares will maintain up with out them. Firms typically aren’t allowed to purchase again inventory throughout so-called “blackout” intervals that start the month earlier than reporting earnings.

David Kostin, chief US fairness strategist at Goldman Sachs, warned that the upcoming blackout interval poses a “near-term risk” to the market. He famous that market volatility tends to be greater throughout buyback blackouts.

Enterprise spending on the rise

Capital spending is on observe for the quickest progress in at the least 25 years, Goldman Sachs estimates.

“Rumors of the demise of capital spending have been greatly exaggerated,” Kostin wrote.

The expansion of enterprise spending, very like buybacks, has been dominated by among the largest firms in the US. Goldman Sachs estimates that 79% of the expansion in S&P 500 capital spending got here from 10 firms alone.

For instance, Google proprietor Alphabet (GOOGL) alarmed buyers in April by disclosing greater than $7 billion of capital expenditures within the first quarter. Fb (FB), below fireplace for its dealing with of the 2016 election, is spending closely on individuals and expertise. Microsoft (MSFT), Intel (INTC) and Micron (MU) are additionally accelerating their capital spending.

Despite the fact that CEOs proceed to inexperienced mild huge buybacks, they’ve been quietly taking a special method with their very own cash. Company insiders bought $10.3 billion of shares in August, probably the most since November 2017, based on analysis agency TrimTabs.

CNNMoney (New York) First printed September 17, 2018: 3:14 PM ET