1. The subsequent debt disaster: There is a $6.3 trillion elephant within the room. And it simply may trigger the following recession.

The final downturn was triggered by Wall Avenue and Individuals accumulating an excessive amount of debt — significantly within the scorching housing market.

A decade later, it is Company America borrowing with gusto. Egged on by extraordinarily low charges, US corporations have piled on a record-setting $6.3 trillion of debt, based on S&P World Rankings.

All that debt is straightforward to disregard proper now. Default charges are minuscule. Corporations are sitting on tons of money, and their coffers are rising because of the hovering US economic system and company tax cuts.

However ultimately, each the economic system and company income will sluggish, leaving corporations much less firepower to pay down debt. And it will not be as simple to roll over the debt that is due. Debt-laden corporations can be susceptible to rising borrowing prices brought on by the Federal Reserve’s rate of interest hikes.

If corporations are caught in a credit score crunch, they should pull again on hiring and funding. That may very well be a recipe for a recession.

“Corporates, not consumers or banks, will cause [the] next recession,” Michael Hartnett, Financial institution of America Merrill Lynch’s chief funding strategist, wrote to purchasers on Thursday.

Company America’s debt binge has helped finance the restoration. Corporations have borrowed to open factories, purchase tools and develop merchandise. A piece of that debt has additionally gone to reward Wall Avenue with large inventory buybacks.

After a decade of low charges, corporations have taken on extra debt relative to the scale of the economic system than ever earlier than. Complete US enterprise debt as a share of GDP is at a file excessive, based on David Ader of Informa Monetary Intelligence.

The riskiest class of debtors has by no means been extra leveraged. Corporations with junk credit score scores are holding a file low $8 of debt for each $1 of money, based on S&P.

After which there are so-called zombie corporations — which may’t even afford curiosity funds, regardless of the robust economic system and low charges.

Ben Breitholtz, information scientist at Bianco Analysis, discovered that 14% of the businesses within the S&P 1500 haven’t got sufficient earnings earlier than curiosity and taxes to cowl curiosity bills. That is above the world common of 10%.

These zombie corporations are in all probability cringing as central bankers slowly finish the easy-money days. The Fed is anticipated to raise charges on Wednesday, the eighth hike since late 2015. 4 extra strikes earlier than the top of 2019 could also be within the playing cards.

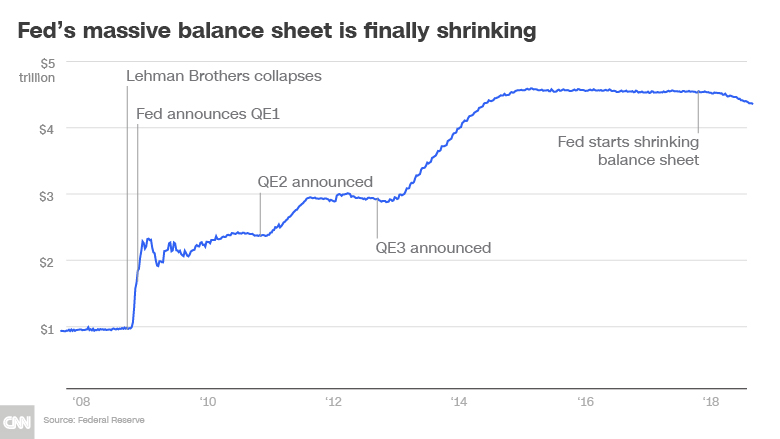

On the identical time, the Fed is trimming its $4.5 trillion steadiness sheet — an experiment that might contribute to larger borrowing prices as international central banks comply with go well with and unload bonds.

Financial institution of America’s Hartnett warned that an “aggressive” Fed in 2019 may set off a “credit crunch” — not simply in rising markets, however in Company America.

2. Commerce conflict: The US-China confrontation will escalate on Monday when the US imposes tariffs on $200 billion price of Chinese language items. On the identical day, China has pledged to retaliate with a tariff on $60 billion of American items.

The commerce conflict is inflicting issues for Walmart, Procter & Gamble and a bunch of different corporations that promote merchandise imported from China or rely on Chinese language items of their provide chains.

3. Nike earnings: What do Nike executives need to say concerning the response to their Colin Kaepernick advert marketing campaign? We’ll discover out Tuesday, when the corporate stories earnings.

Nike has had a superb yr: US gross sales are rising, and the inventory is up 35%.

4. Financial system watch: The US authorities on Thursday will give the ultimate studying on financial progress within the second quarter. The earlier revision confirmed a powerful progress price of 4.2%.

5. Coming this week:

Monday — US imposes tariffs on $200 billion price of Chinese language items; MacOS Mojave launches

Tuesday — KB Dwelling (KBH) and Nike (NKE) earnings; US shopper confidence

Wednesday — Mattress Tub & Past and Carmax earnings; Federal Reserve rate of interest determination; US new house gross sales for August

Thursday — Ceremony Support, Carnival and Accenture earnings; ultimate revision of US second-quarter GDP

Friday — Finish of Q3

CNNMoney (New York) First printed September 23, 2018: 7:40 AM ET