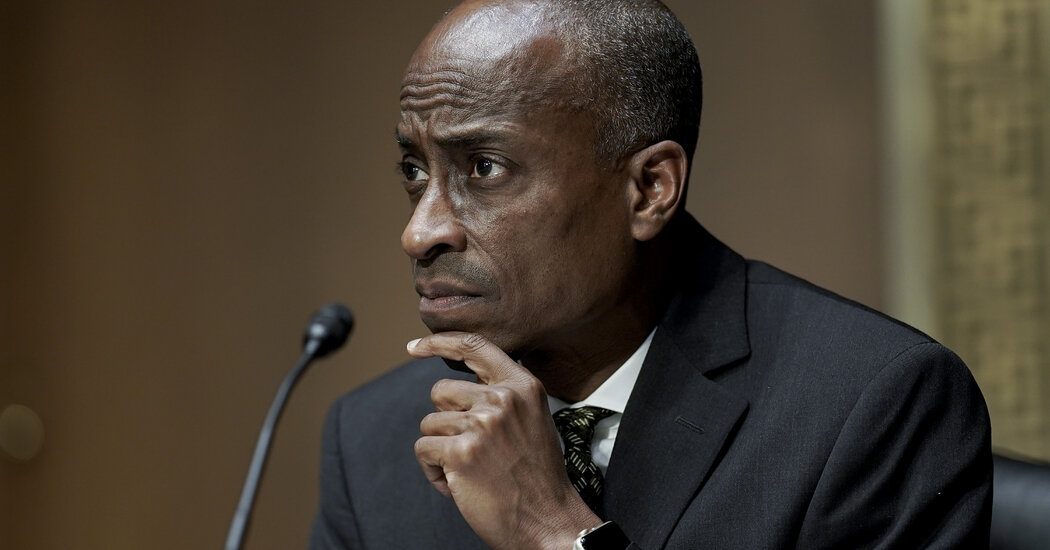

Philip N. Jefferson, a college administrator and academic economist, was confirmed to the Federal Reserve’s Board of Governors on Wednesday.

Senators approved him for the job in an overwhelming bipartisan 91-7 vote. He is the third of President Biden’s nominees to secure a spot on the Fed’s seven-person board: Lisa D. Cook was confirmed as a governor on Tuesday, and Lael Brainard was confirmed as vice chair last month.

Mr. Jefferson, who was most recently vice president for academic affairs at Davidson College, was born in Washington, D.C., and holds a Ph.D. in economics from the University of Virginia. He has been an economist at the Fed board, and has written about poverty and monetary policy’s effect on the labor market, among other topics.

The White House has also renominated Jerome H. Powell as Fed chair, though Mr. Powell is still awaiting a final confirmation vote. Senators said that vote was expected as soon as Thursday.

The administration’s nominee for the final open Fed job — the vice chair for supervision — has yet to have a committee hearing and vote. Mr. Biden’s initial nominee for the position, Sarah Bloom Raskin, withdrew from consideration after it became clear that she would not pass the Senate. Michael S. Barr was put up for the job more recently.

If those picks are confirmed, Mr. Biden will have nominated or renominated five of the Fed’s seven governors. The Fed is independent of politics, so those appointments are the main way that the White House can shape the future of monetary policy, which is used to keep inflation stable and employment high.

Governors at the Fed’s board in Washington hold constant votes on monetary policy and oversee the nation’s largest banks. They set interest rates to guide the economy alongside 12 regional reserve bank presidents, five of whom hold a vote on monetary policy at any given time.

Mr. Jefferson and Ms. Cook are likely to support the Fed’s current project: reining in rapid inflation. Consumer prices climbed 8.3 percent in the year through April, data released Wednesday showed, an uncomfortably rapid pace of increase. Fed officials are raising rates at the fastest pace in decades as they try to tamp down price pressures and bring the situation under control.

“The spike in inflation we are seeing today threatens to heighten expectations of future inflation,” Mr. Jefferson said during his confirmation hearing. “The Federal Reserve must remain attentive to this risk and ensure that inflation declines to levels consistent with its goals.”