Millennials Want to Retire at 50. How to Afford It Is Another Matter.

“You don’t want to have all of your savings in pretax retirement…

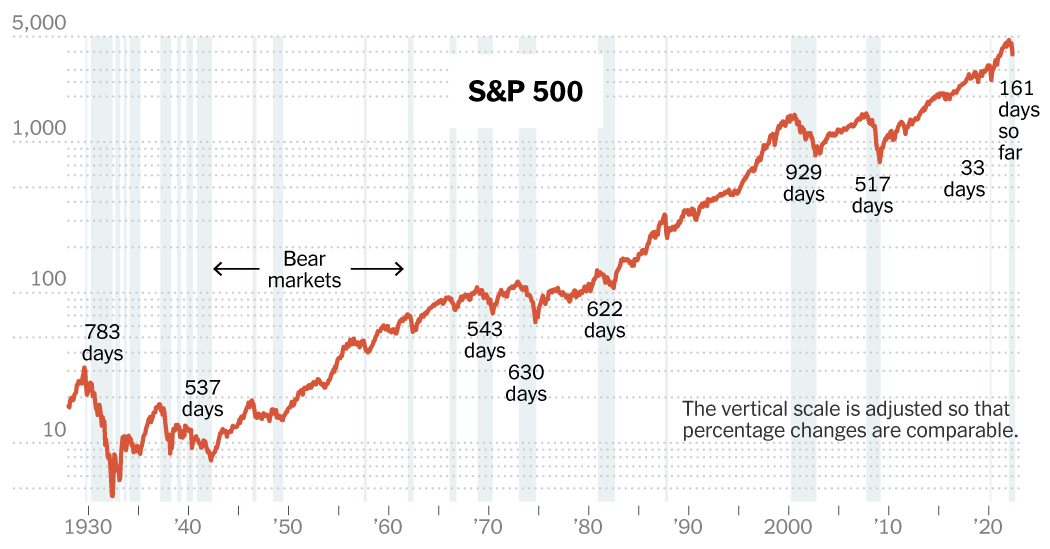

When Stocks Become Bear Markets

The S&P 500 on Monday dropped into its second bear market of…

How to Save for Retirement as a Freelancer

Savings and investment vehiclesOnce you have a system or plan for saving…

When Financial Cheating Hurts Your Retirement Plan

With counseling and professional financial guidance, couples can avoid cascading failures that…