The stock market’s staggering run of losses came to an end last week, with the S&P 500 snapping a seven-week losing streak and pulling away from the brink of a bear market with a 6.6 percent bounce through Friday.

But the concerns that drove Wall Street’s panic this year remain unresolved. It’s far too soon to know if skyrocketing consumer prices have peaked, if the Federal Reserve has charted the right path for interest rates, or how well the economy will be able to hold up in the face of fast inflation and rising borrowing costs.

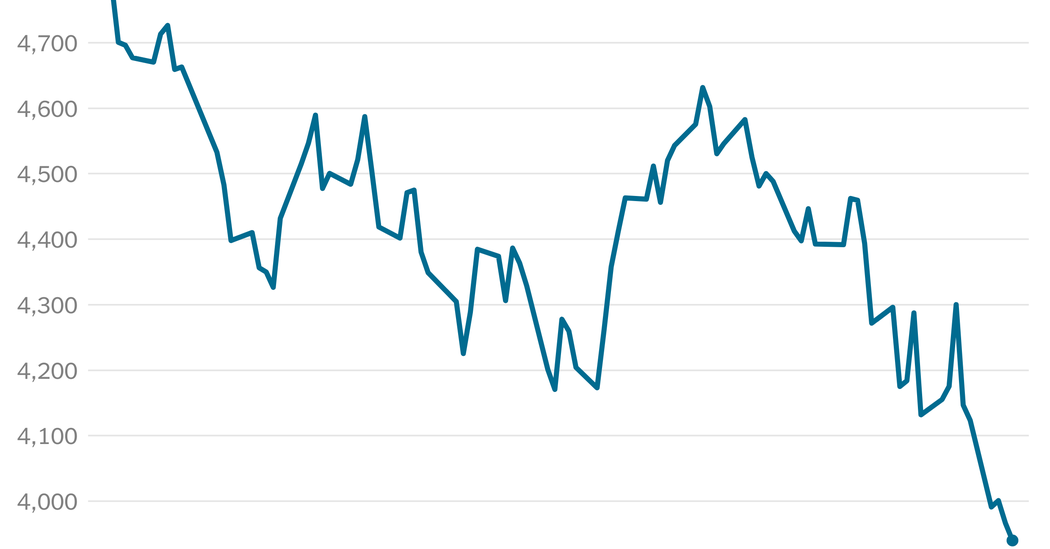

Until there’s clarity on those issues, analysts say, it would be a mistake to presume that this year’s drop in stocks was over. As share prices have tumbled, falling about 13 percent since early January, predictions that the selling has run its course have repeatedly turned out to be wrong, with the market changing direction as each new piece of data on the economy came in. Last week’s bounce, as investors plowed some $20 billion into global stock funds, could be another short-lived rally.

“There’s no certainty, especially in the short term,” said Victoria Greene, chief investment officer at G Squared Private Wealth, an investment adviser. “This could be a choppy summer where you’re going to have ups and downs and you’re going to get jerked around.”

The recent gains were underpinned by some good news about the health of American consumers. Several retailers, including Macy’s and Nordstrom, reported better-than-expected quarterly results, saying shoppers are willing to trade up on their purchases as they start to travel again and return to offices. On Friday, data from the government showed that Americans continued to spend in April, tapping into their savings to do so even as they contended with higher costs.

Just a week earlier, reports from two retail giants — Walmart and Target — had triggered the exact opposite reaction, raising alarms that some consumers had reached their limit and that inflation was starting to hit corporate profits, too. That fear helped push the S&P 500 to its seventh consecutive weekly loss, the longest stretch of declines since 2001 after the dot-com bubble burst.

The mixed reports speak to the way inflation is affecting the population differently, economists say, with lower-income Americans changing their habits as a result. But they also point to one of the biggest challenges investors have faced as they’ve tried to adjust expectations: a constantly shifting picture in which debates seem to be settled one day only to be resurrected the next.

Not long ago, the market’s rally was relentless, lifting shares of technology giants like Apple, which in January was briefly worth $3 trillion, the first company ever to reach that lofty point. Even as the pandemic raged, the S&P 500 was pulled from one record to the next, rising 90 percent over three years through 2021.

Those were gains fueled by near-zero interest rates, slashed to that level by the Fed in March 2020. The same policies, as well as government stimulus spending, contributed to a rise in consumer demand for everything from cars to electronics that helped ignite the inflation problem spooking investors today.

With consumer prices rising at their fastest pace in 40 years, the Fed has abruptly changed course, raising interest rates in March for the first time since the pandemic began in an effort to cool the economy. Russia’s invasion of Ukraine and new Covid-19 lockdowns in China also raised risks to growth, the supply of food and energy, and the prices of goods in general.

All of these factors have led economists to slash their expectations for economic growth in the United States. A survey from the National Association for Business Economics showed that forecasters expect gross domestic product to grow 1.8 percent in the fourth quarter from a year earlier, down from their prediction in February of 2.9 percent.

Now, investors expect the Fed to raise its benchmark borrowing rate to as high as 2 percent by July, a big jump but by no means the last increase anticipated this year. In addition to being a drag on the economy, the higher borrowing costs mean investors have been forced to rethink what they’re willing to pay for stocks or other risky investments — and the highest fliers were hit hardest.

“The world is repricing for the end of extraordinarily low interest rates and extraordinarily accommodative monetary policy,” said David Lefkowitz, head of equities for the Americas at UBS Global Wealth Management. “The losses feel much more painful than the pleasure we received from seeing the gains.”

All the selling could also have an impact on the real economy, as retirement nest eggs, college savings accounts or rainy-day funds lose value and chief executives become less willing to take risks.

“A lot of wealth has been destroyed in the last five months,” said Russ Koesterich, portfolio manager of the BlackRock Global Allocation Fund. “That has an effect on corporate sentiment and hiring and investing plans by companies. It also has an effect on consumer behavior.”

For now, the stock market has narrowly avoided falling into a bear market, typically defined as a 20 percent decline from a recent high that signifies a severe downturn in sentiment about the market and the economy.

It came close on May 20, though, briefly falling into that level before rallying by the end of trading. After last week’s bounce, the S&P 500 is 13.3 percent below its Jan. 3 record — far from bear market territory.

But there are other ways to measure unease among investors. One of them is that big swings in stock prices are coming more frequently these days. Even if it’s easier to stomach than a drop, last week’s gain was part of this volatility.

“This is volatility, too,” Steve Sosnick, a trader and chief strategist at Interactive Brokers, said of the week’s gain. “This is what I like to call socially acceptable volatility.”

There will be a clearer turning point, Mr. Sosnick said, when investors decide the Fed is done raising rates.

“The Fed doesn’t necessarily have to be finished — people just have to perceive they will be finished,” he said. Knowing when that will happen, though, is impossible at this point.